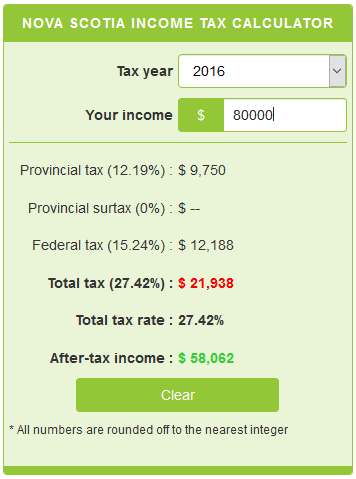

Salary Calculator Nova Scotia

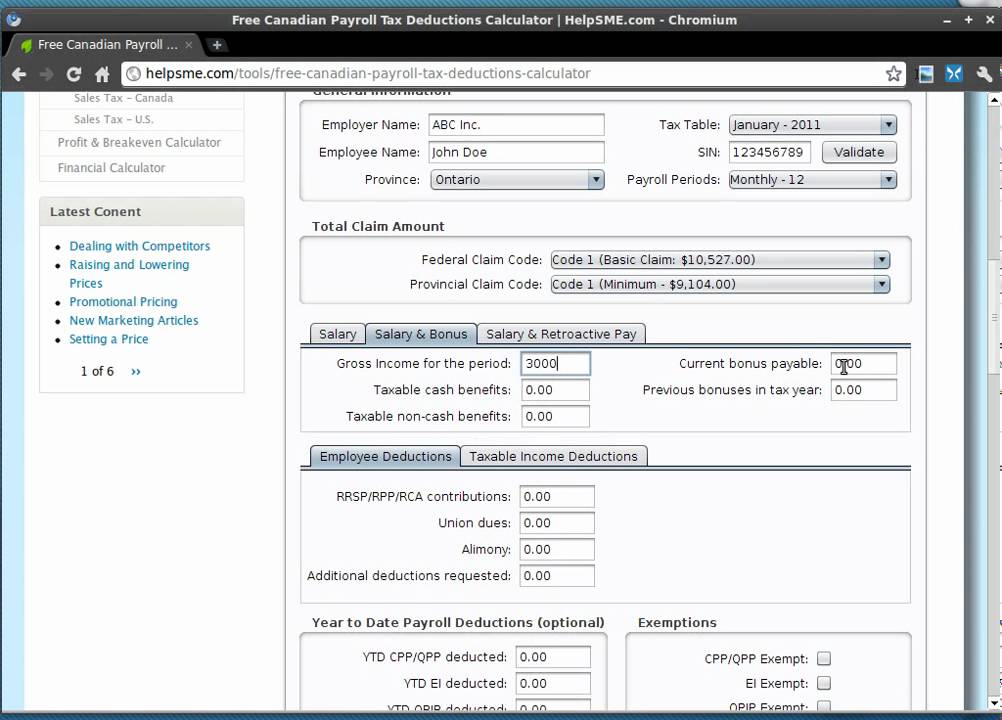

Just in case you need a simple salary calculator that works out to be approximately 3428 an hour. Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums.

Canada S Federal Personal Income Tax Brackets And Tax Rates 2021 Turbotax Canada Tips

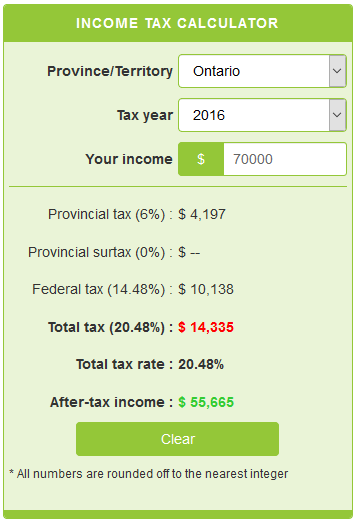

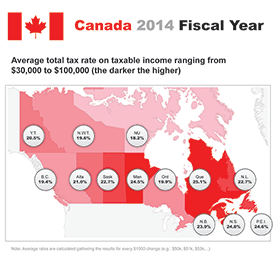

Your average tax rate is 261 and your marginal tax rate is 408.

Salary calculator nova scotia. As of Jun 12 2021 the average annual pay for a Registered Nurse in Nova Scotia is 71296 an year. If you make 52000 a year living in the region of Nova Scotia Canada you will be taxed 13550. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

If the income is 25 000 or less. This is the equivalent of 1371week or 5941month. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Nova Scotia Canada.

This tax calculator is used for income tax estimation. The average calculation reviewer salary in Nova Scotia Canada is 45707 or an equivalent hourly rate of 22. For an employee.

Net Income Taxable Income - Canadian Tax - Nova Scotia Tax - CPP - EI. The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Nova Scotia Canada.

Canadian Payroll Calculator by PaymentEvolution. Nova Scotia Mortgage Calculator allows you to calculate your monthly mortgage payments for the pruchase of real estate using current Nova Scotia mortgage rate. The Nova Scotia Income Tax Salary Calculator is updated 202122 tax year.

This is income tax calculator for Nova Scotia province residents for year 2012-2020. Nova Scotia Nominee Program NSNP 2021 is Nova ScotiasPNP for Canada Immigration. On the other end a senior level funeral director 8 years of experience earns an average salary of 104440.

Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. Your average tax rate is 221 and your marginal tax rate is 349. 7 lignes Easy income tax calculator for an accurate Nova Scotia tax return estimate.

That means that your net pay will be 38450 per year or 3204 per month. The same calculation must be made for the self-employed worker. The amount can be hourly daily weekly monthly or even annual earnings.

Calculation of Nova Scotia tax. Nova Scotia PNP Points Calculator 2021. Nova Scotia income tax calculator.

Enter the number of hours worked a week. What salary does a Nova Scotia earn in your area. Enter your pay rate.

Enhancement 3000 65 500 -25 000 6 100 Enhancement 3000 40 500 006 Enhancement 3000 2430 570. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Nova Scotia Canada. The calculator is updated with the tax rates of all Canadian provinces and territories.

For self-employed workers. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family. Individuals are resident in the CPP.

Add the enhancement to the BPA for. The following explanation simplifies the calculation of the tax by displaying only the final result of the Net Income. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada.

This marginal tax rate means that your immediate additional income will be taxed at this rate. On the other end a senior level wait staff 8 years of experience earns an average salary of 36470. Current tax rates in Nova Scotia and federal tax rates are listed below.

The Nova Scotia Income Tax Salary Calculator is updated 202122 tax year. An entry level wait staff 1-3 years of experience earns an average salary of 26935. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Enter the number of pay periods. Please use Intuit TurboTax if you want to fill your tax return and get tax rebate for. If the income is over 25 000 and under 75 000.

What is NSNP 2021. This is required information only if you selected the hourly salary option. That means that your net pay will be 40512 per year or 3376 per month.

2 Nova Scotia Salaries provided anonymously by employees. If You are looking to calculate your salary in. The self-employed must pay.

NSNP selects highly skilled immigration aspirants that want to live and work in Nova Scotia and nominates them to IRCC for Canadian PR Visa. An entry level funeral director 1-3 years of experience earns an average salary of 59729.

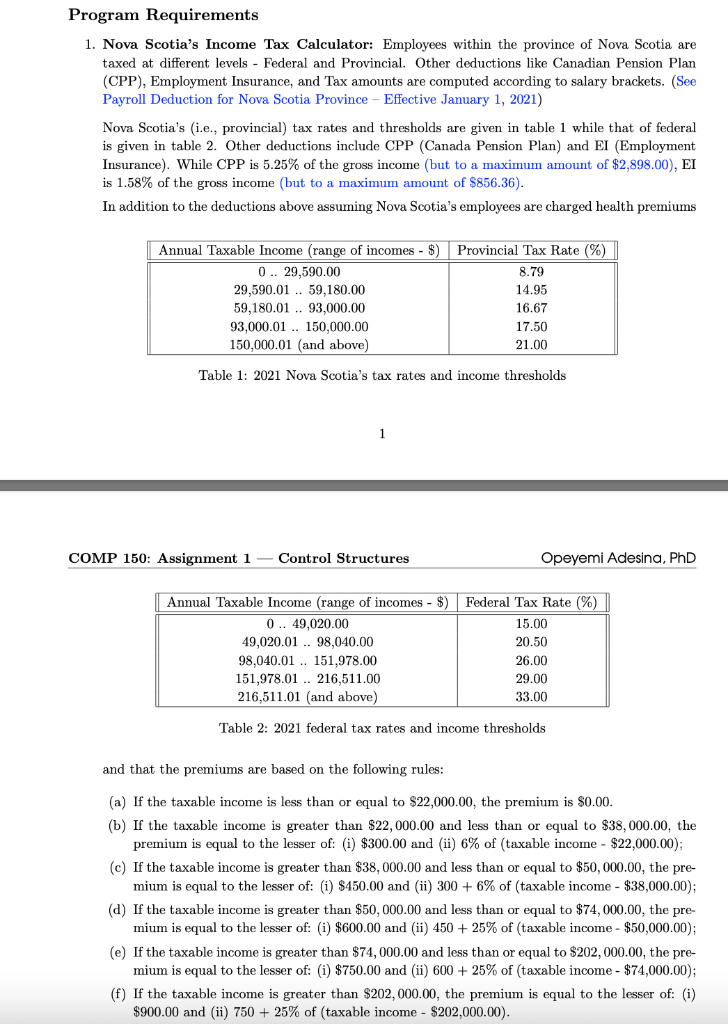

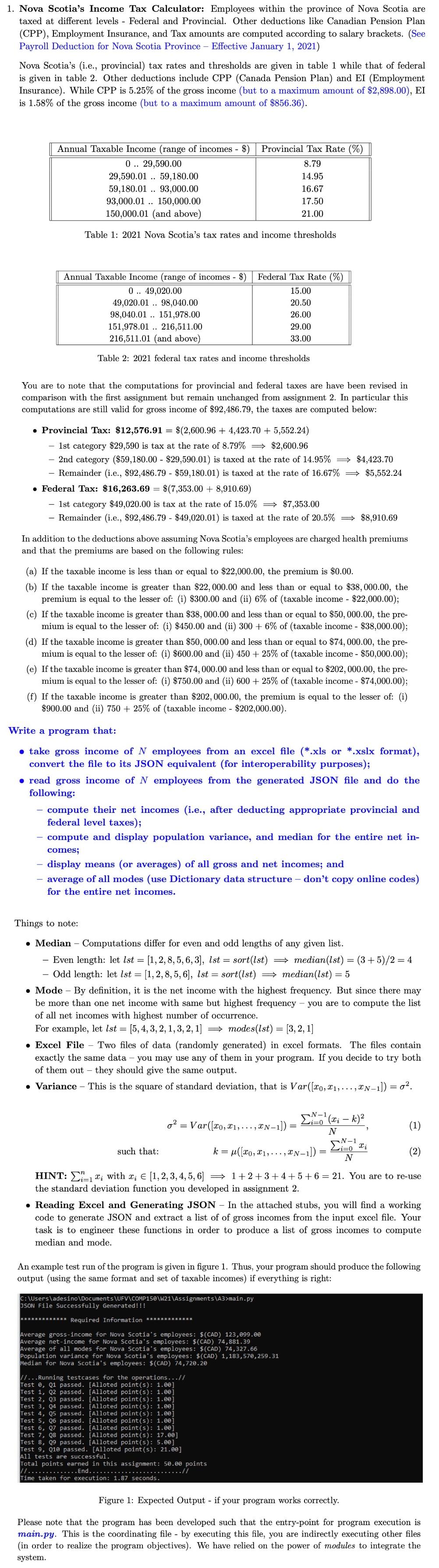

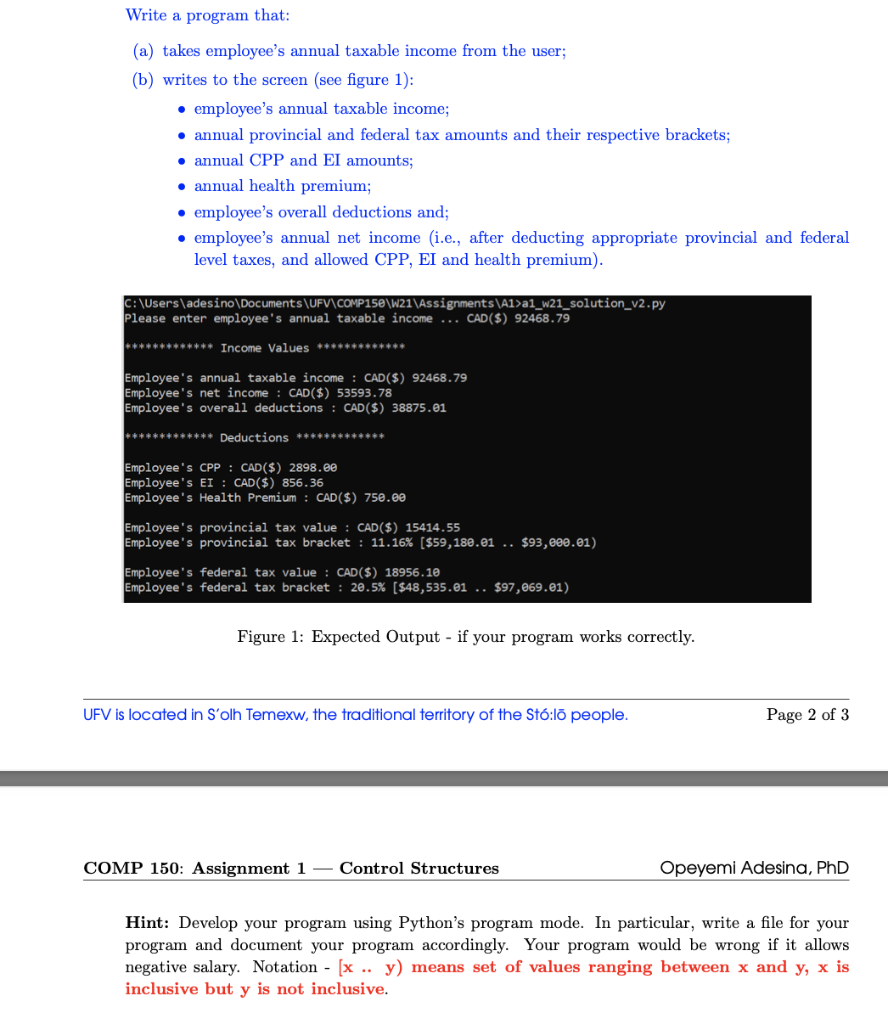

Nova Scotia S Income Tax Calculator Employees Within Chegg Com

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

Workers Compensation Perspectives Are Wages Or Salary Fully Covered By Workers Compensation Insurance

Gst Calculator Goods And Services Tax Calculation

Saskatchewan Income Tax Calculator

Canada Salary Calculator Hourly Salary In Canada Gross Income Salary Calculator

2021 Nova Scotia Province Tax Calculator Canada

2021 Salary Calculator Robert Half

Average Salary In Nova Scotia 2021 The Complete Guide

Income Tax Calculator Calculatorscanada Ca

1 Nova Scotia S Income Tax Calculator Employees Chegg Com

Canadian Tax Calculator 2020 2021

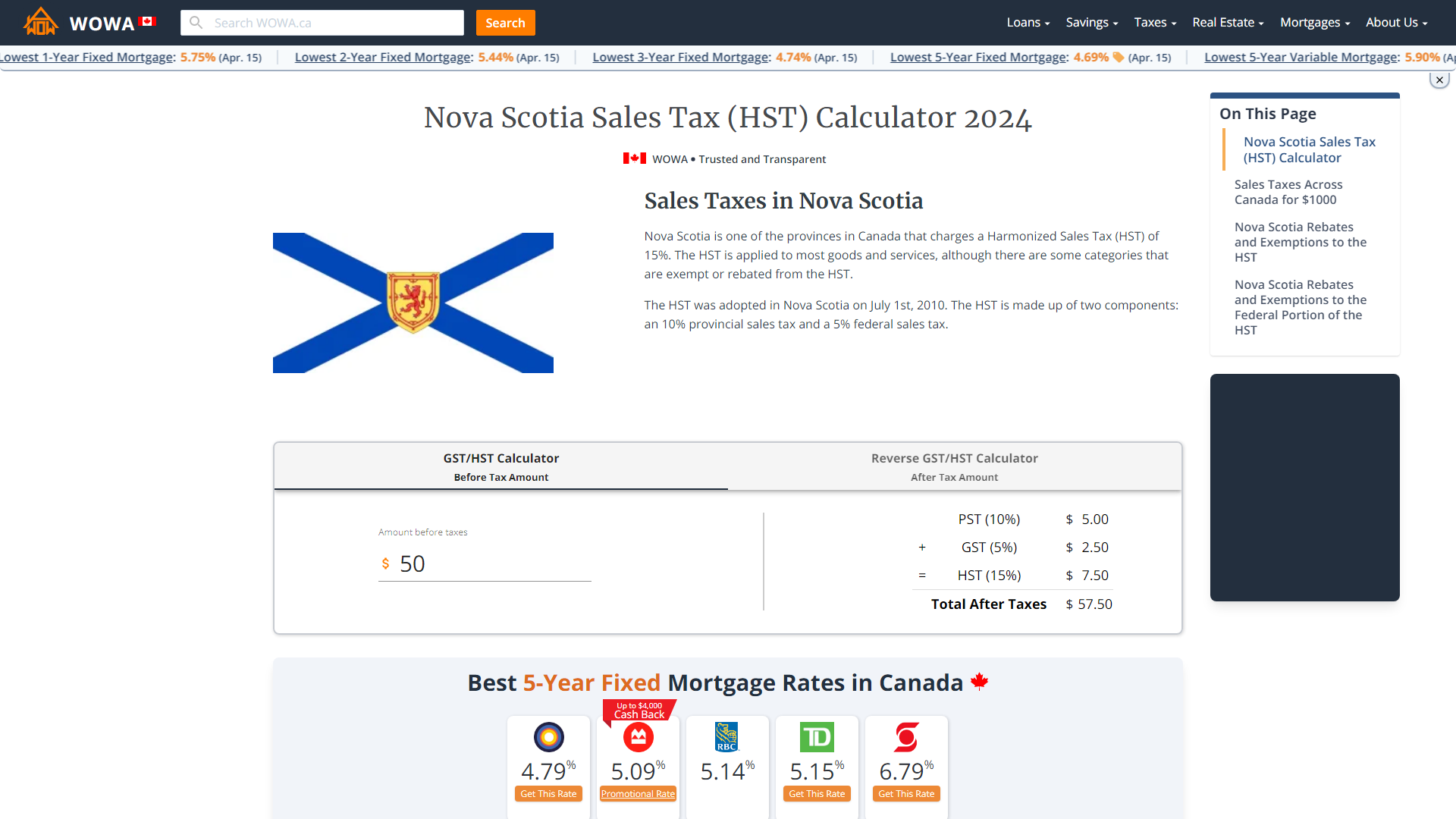

Nova Scotia Sales Tax Hst Calculator 2021 Wowa Ca

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

How Much Taxes Are Taken Out Of Paycheck In Canada

Nova Scotia Income Tax Calculator Calculatorscanada Ca

Nova Scotia S Income Tax Calculator Employees Within Chegg Com

Avanti Gross Salary Calculator

Post a Comment for "Salary Calculator Nova Scotia"