Wage Calculator Nc

The results are broken up into three sections. Living Wage Calculation for Fayetteville NC.

Payroll Calculator Free Employee Payroll Template For Excel

North Carolina Salary Paycheck Calculator Results Below are your North Carolina salary paycheck results.

Wage calculator nc. 23 lignes Living Wage Calculation for North Carolina. The living wage shown is the hourly rate that. The tool provides information for individuals and households with one or two.

30 8 260 - 25 56400. North Carolina has a flat income tax rate of 5499 meaning all taxpayers pay this rate regardless of their taxable income and filing status. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in North Carolina. The living wage shown is the hourly rate that an. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in North Carolina.

NC Workers Comp Calculators Use the public workers compensation calculators including TTD TPD PPD and PTD. The assumption is the sole provider is working full-time 2080 hours per year. This British Columbia net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2021.

Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Carolina paycheck calculator. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for North Carolina residents only. Calculate Present Value Days Between Dates and Date Forecaster.

SmartAssets North Carolina paycheck calculator shows your hourly and salary income after federal state and local taxes. The Pay Calculator calculates base pay rates allowances and penalty rates including overtime. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

No cities with North Carolina have local income taxes. The living wage shown is the hourly rate that. All bi-weekly semi-monthly monthly and quarterly figures.

There are legal minimum wages set by the federal government and the state government of North Carolina. This North Carolina hourly paycheck calculator is perfect for those who are paid on an hourly basis. Welcome to the North Carolina Wage Calculator.

The tool provides information for individuals and households with. Calculate accurate take home pay using current Federal and State withholding rates. The adjusted annual salary can be calculated as.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The North Carolina Minimum Wage is the lowermost hourly rate that any employee in North Carolina can expect by law. Enter your info to see your take home pay.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The assumption is the sole provider is working full-time 2080 hours per year. 23 lignes Living Wage Calculation for Raleigh NC.

This calculator is based on 2021 British. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. To help you find the information you need wed like to know if you are an employee or an employer.

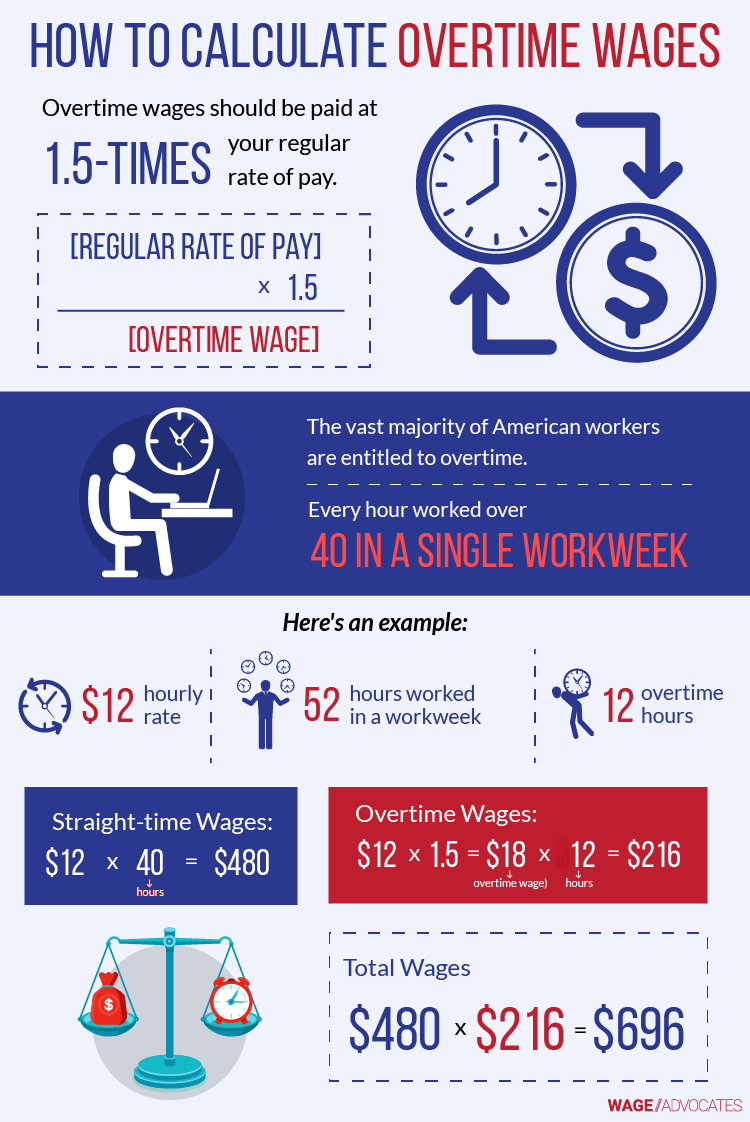

This calculator can determine overtime wages as well as calculate the total earnings for tipped employees. 23 lignes Living Wage Calculation for Asheville NC. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

Fill the weeks and hours sections as desired to get your personnal net income. Wage Calculator Nc This calculator reflects all the 2018 federal withholding tax changes. Its the tool our Infoline advisers use to answer your enquiries.

It is not a substitute for the advice of an accountant or other tax professional. North Carolina Minimum Wage Calculator 2021 Use our calculator to discover the North Carolina Minimum Wage. Living Wage Calculation for Charlotte-Concord-Gastonia NC.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. ZenPayroll Inc dba Gusto Gusto does not warrant promise or guarantee that the information in the Paycheck Calculator.

Average Weekly Wage North Carolina Workers Compensation

Introducing A Social Benefits Calculator For Forsyth County Nc

North Carolina Paycheck Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2021

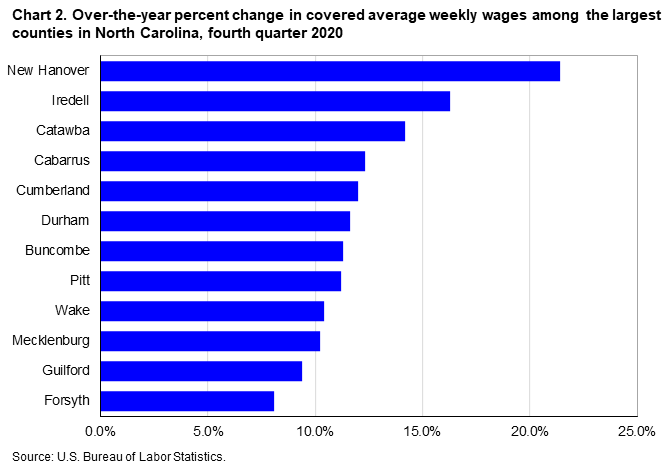

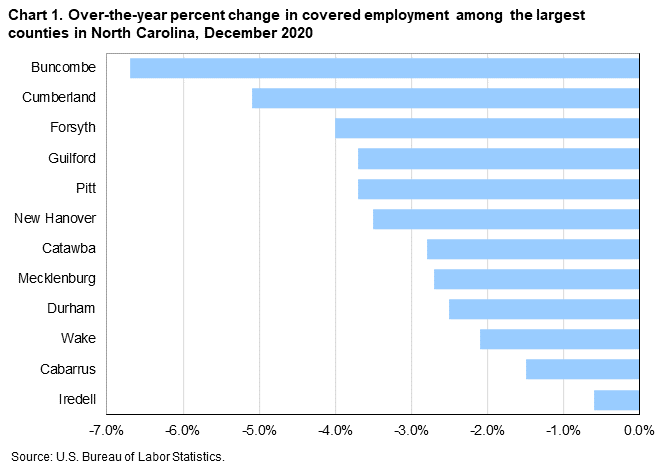

County Employment And Wages In North Carolina Fourth Quarter 2020 Southeast Information Office U S Bureau Of Labor Statistics

Nc Coronavirus Single Adults May Not Be Able To Cover Bills With Their 1 200 Stimulus Check Abc11 Raleigh Durham

County Employment And Wages In North Carolina Fourth Quarter 2020 Southeast Information Office U S Bureau Of Labor Statistics

Top 6 Best Gross Income Pay Calculators 2017 Ranking Annual Income Net Monthly Wage Salary Calculations Advisoryhq

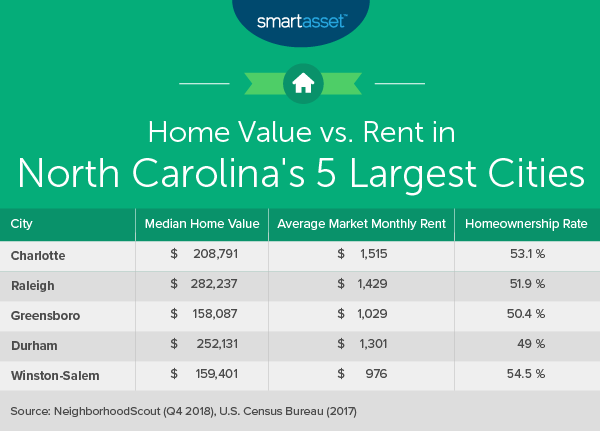

The Cost Of Living In North Carolina Smartasset

North Carolina Salary Calculator 2021 Icalculator

Gs Pay Scale 2021 Nc Gs Pay Scale 2021

North Carolina Restaurant Adding 20 Fair Wage Service Fee To Every Bill Wgn Tv

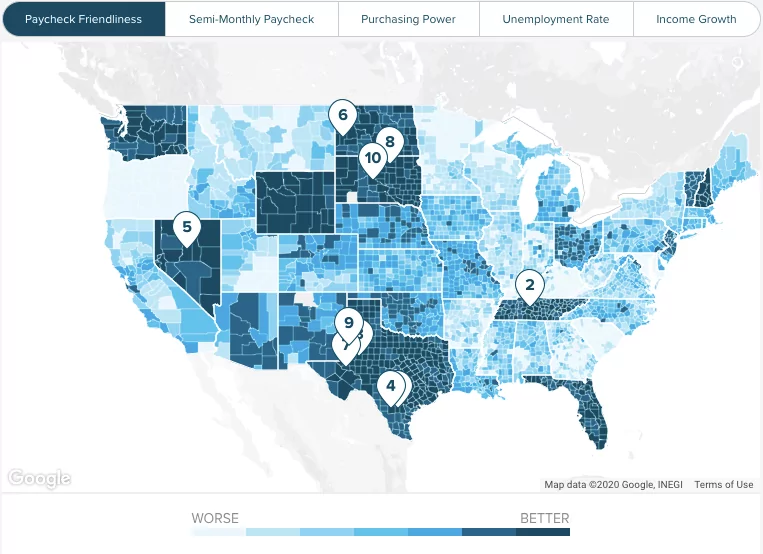

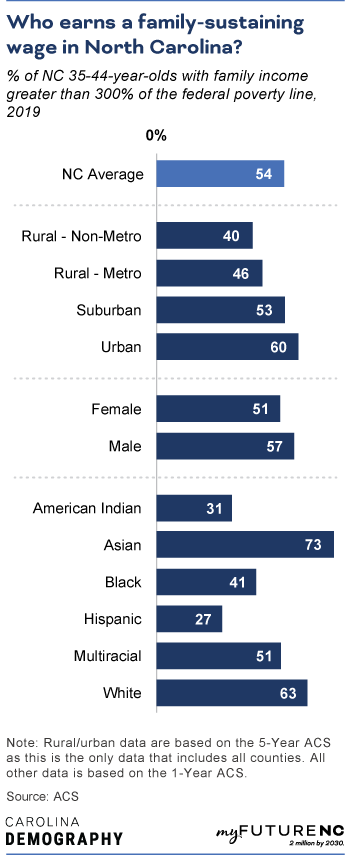

North Carolina Family Sustaining Wage

North Carolina Paycheck Calculator Smartasset

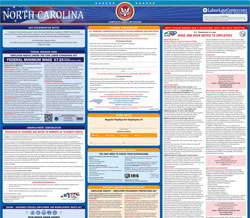

North Carolina Minimum Wage 2021 Minimum Wage Org

North Carolina Sales Tax Calculator Reverse Sales Dremployee

North Carolina Family Sustaining Wage

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

North Carolina Paycheck Calculator Smartasset

Post a Comment for "Wage Calculator Nc"