Annual Income Vs Adjusted Gross Income

Why is adjusted gross income necessary. Adjusted gross income AGI is an individuals taxable income after accounting.

Should I Use Net Income Or Gross Income For Tenant Screening The Closing Docs

When your gross income is smaller you pay fewer taxes.

Annual income vs adjusted gross income. Unlike gross income adjusted gross income is the total taxable income after deductions and other adjustments. Your gross income includes not only wages but also business income interest income royalties capital gains dividends alimony retirement distributions tips and any other form of money you earned or accrued in the span of a year. What is annual gross income.

Personal gross annual income is the amount you earn in one year before taxes and deductions. For an individual annual gross income equals the amount of money that you earned in a year before taxes. For this reason its a good idea to get to a better understanding of the difference between your gross income and adjusted gross income and how it impacts your personal financial planning.

If you contributed 2000 to a traditional IRA and paid 500 in student loan interest your adjusted gross income is 48500. Gross income is the total amount of money you make in a year before taxes Adjusted gross income is your gross income minus any. Your gross annual income is used to determine what deductions exemptions and credits are available to you to determine your total taxable income and then your total tax obligations for the year.

These sources of income could be salary income from business income. This is your gross income with above the line deductions applied. If youre a business your annual gross income would be your.

Gross annual income refers to the total earnings before deductions during a fiscal year. This number represents your total or gross income minus any eligible adjustments or deductions. These deductions known as adjustments to income make your gross income amount smaller.

Profit obtained from selling any property is added to other sources of income to arrive at adjusted gross income. Subtract the deductions from total income and divide by 12 Subtracting your deductions from your total annual income gives you your annual adjusted gross income. When calculating income tax taxpayers are concerned with Adjusted Gross Income since it is the basis for calculating most deductions.

Above the line deductions are available to everyone regardless of whether youre itemizing or taking a standard deduction. Your adjusted gross income is simply put your gross total annual income after adjustments have been made. Your gross income refers to all your pre-tax earnings for the year while your adjusted gross income is often lower and refers to your income after allowed tax deductions.

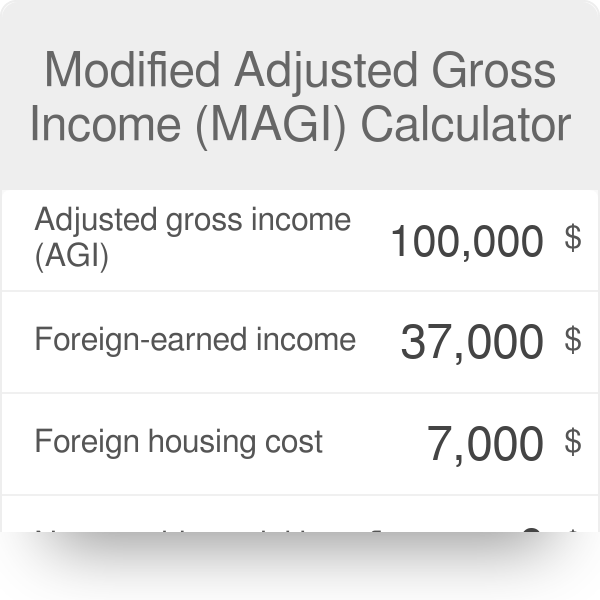

While adjusted gross income refers to an employees total annual income minus all qualifying deductions modified adjusted gross income according to the IRS refers to a persons adjusted gross income plus certain deductions previously subtracted from their total taxable income. Your gross annual income includes your salary bonuses overtime. AGI or adjusted gross income is a different animal.

Gross income is the entire amount of money an individual makes including wages salaries bonuses and capital gains. It is the total income of any individual minus some specific items. Adjusted Gross Income AGI Adjusted gross income is always more than taxable income.

While gross income represents every cent of income youve earned throughout the year youll only pay income taxes on your adjusted gross income. After these are subtracted from the gross income the resulting adjusted gross income is used to calculate income tax liability. Deductions and Exemptions When you file your taxes you can either claim the standard deduction which is a fixed amount based on your filing status or the sum of your itemized deductions which include charitable contributions state and local taxes and mortgage.

Dividing this number by 12 will. Gross income is that AGI is adjusted to account for allowable tax deductions. Annual gross income is the money earned during the year before subtracting deductions.

The concept of gross annual income is vital to both individuals and businesses especially when it comes to preparing income tax returns or applying for loans. Gross income and adjusted gross income are some common income tax terms that you may come across on your federal tax return. Gross income refers to the salary or hourly wages set by an employer before deductions.

So what is adjusted gross income exactly. Its logical then that the very first page of IRS forms 1040 and 1040A are devoted to calculating AGI. Adjusted gross income often is referred to as net income because AGI constitutes the net amount of income that is taxed after all tax payments and credits are factored in.

When computation of income tax is done it is not the gross income but adjusted gross income that is looked for. The difference between adjusted gross income vs. But how do you calcula.

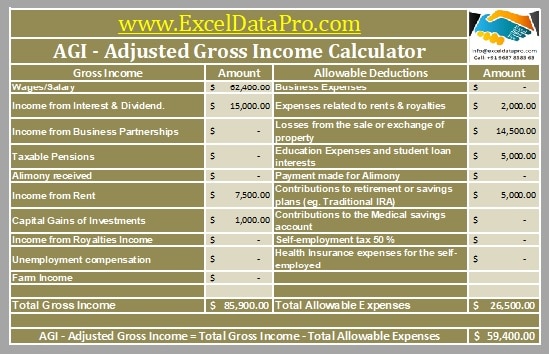

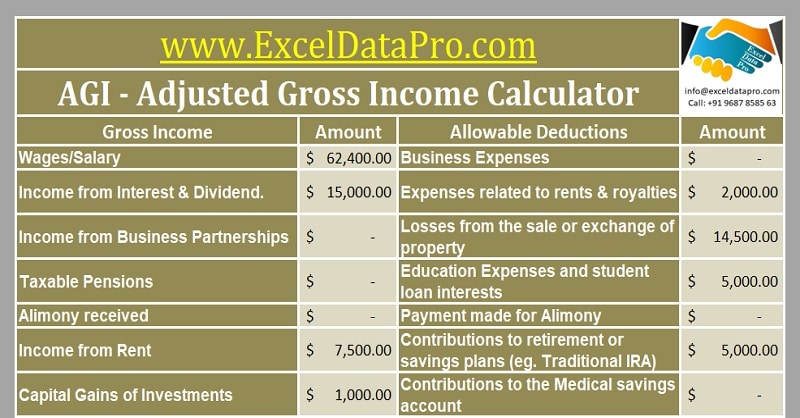

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Gross Income Vs Net Income Creditrepair Com

Gross Income Vs Net Income Creditrepair Com

What Is Taxable Income Mintlife Blog

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Figuring Your Irs Taxable Income Adjustable Gross Income Agi Vs Modified Adjustable Gross Income Magi Aving To Invest

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

:max_bytes(150000):strip_icc()/GettyImages-175520675-83d7a74c00184d89aac2019cbb44e41b.jpg)

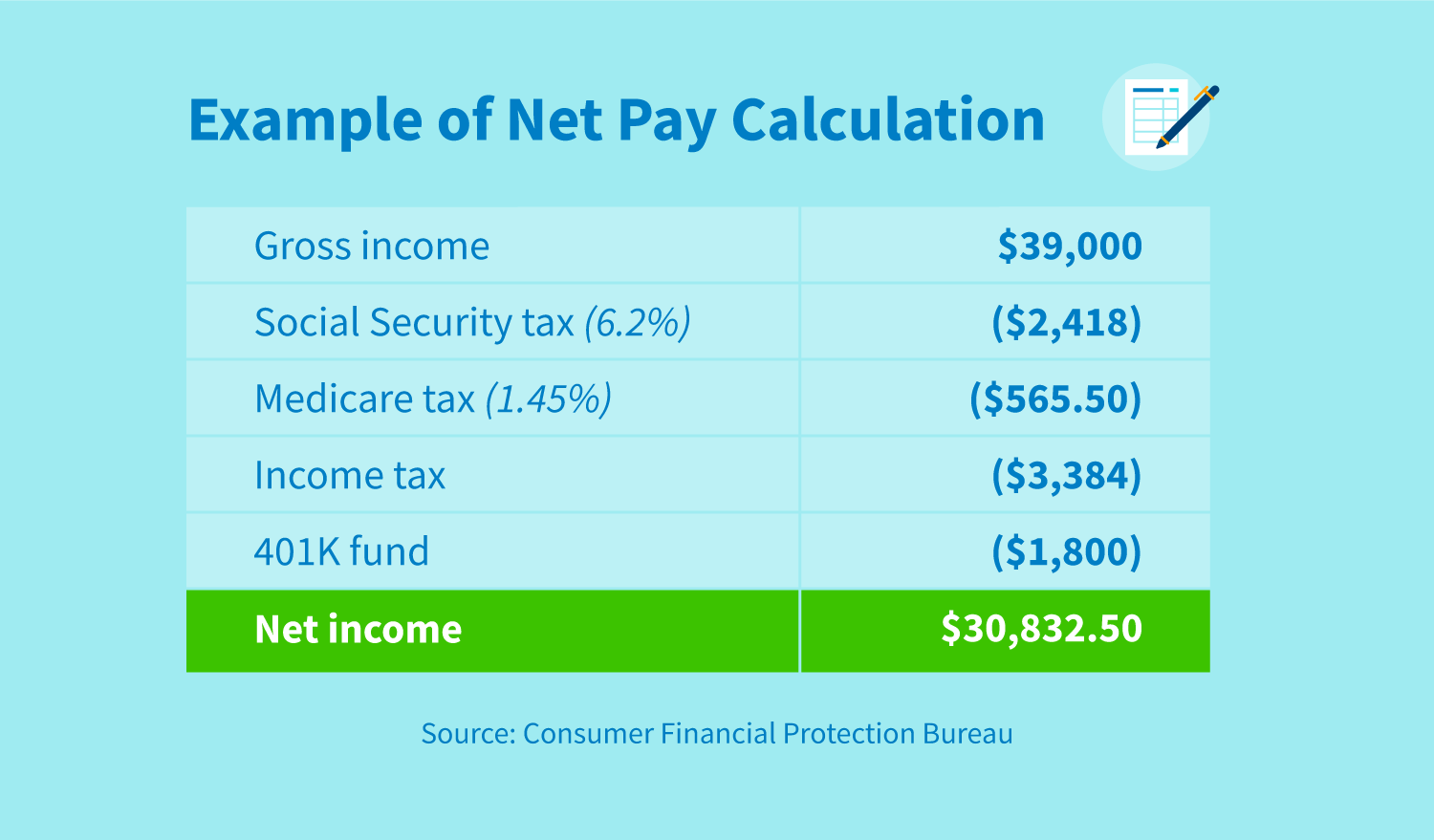

Net Income Vs Adjusted Gross Income Agi What S The Difference

Gross Income Vs Net Income Creditrepair Com

Figuring Your Irs Taxable Income Adjustable Gross Income Agi Vs Modified Adjustable Gross Income Magi Aving To Invest

/GettyImages-904286032-4cc94e81854841989b260d5df5ae98d6.jpg)

Net Income Vs Adjusted Gross Income Agi What S The Difference

Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

Operating Income Vs Gross Profit

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Adjusted Gross Income Vs Modified Agi

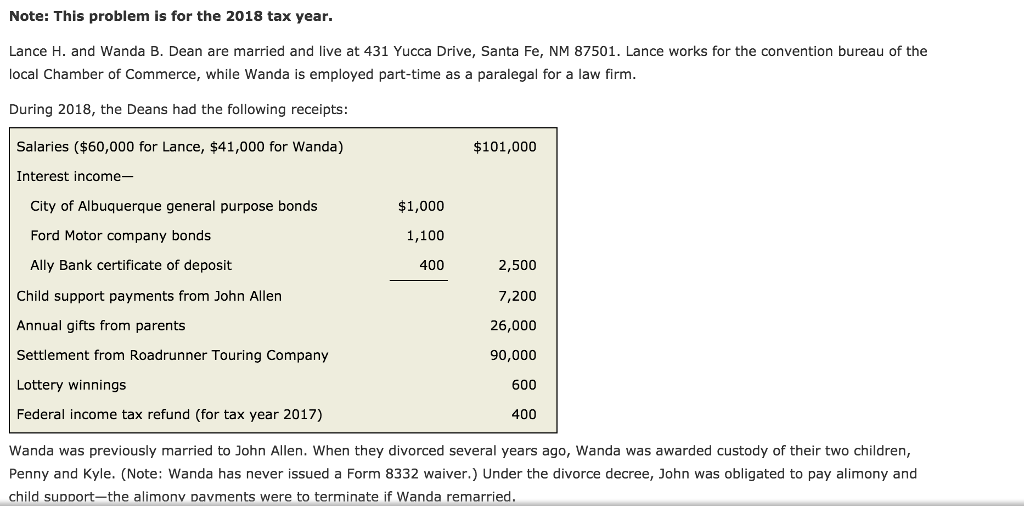

A 2 Calculate Taxable Gross Income 3 Chegg Com

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Adjusted Gross Income What Is Adjusted Gross Income Agi

Post a Comment for "Annual Income Vs Adjusted Gross Income"