Ytd Gross Salary Meaning

Year to date column shows total Gross Salary total deductions total tax deucted and net income based on a calendar year. Year to date YTD is cumulative earnings accrued from the beginning of the year January 1st to the current date of the payroll.

Understanding The Contents Of A French Pay Slip Fredpayroll

YTD personal income on the other hand includes income from all sources and isnt reduced by expenses.

Ytd gross salary meaning. It includes only payments actually made to or on behalf of the employee. Simply stated your YTD short for Year-to-Date amount shows the sum of your earnings from the beginning of the current calendar year to the present time or the time your pay stub was issued. YTD Net Pay - this is the amount a person earned for the year after deductions.

What is total net pay. YTD is calculated as a straight sum of similar line items on each paystub from the beginning of the year. What is the meaning of year-to-date YTD in a salary slip.

Taxable Pay Taxable pay is Gross Pay minus any tax-free elements eg. What is total gross pay. Most banks and lenders will use a Year to Date calculator to work out the income figure to use on your home loan application and in a lot of cases the banks will use the lower figure of your YTD income and your group certificate.

YTD income for businesses is referred to as net income and is reduced by business expenses. Your final paycheck of the year will have almost the same information as on your T4 slip. The paystubs keep track of various YTDs like regular earnings withholdings and other deductions along with gross pay.

Taxable Income Taxable Income Taxable income refers to any individuals or business compensation that is used to determine tax liability. Year-to-date -- or YTD for short -- income represents the income youve received so far this year. TD OR YTD This means To Date or Year To Date.

What is Year to Date YTD in payroll. What does YTD stand for in Logistics. Lenders use the year to date calculation to determine annualized monthly income.

For a business year-to-date represents the earnings all employees. There are several practical uses for understanding your YTD amounts. Gross income includes all income you receive that isnt explicitly exempt from taxation under the Internal Revenue Code IRC.

It also includes payments paid in this current fiscal or calendar year but not necessarily received this year. In other words Year to Date YTD income represents what you should earn over the course of 12 months. As well as showing earnings and deductions for that specific pay period your payslip should also show you a combined total for that tax year to date.

Taxable income is the portion of your gross income thats actually. For employees year-to-date payroll is their gross income. In this article well take a closer look.

For a company gross income equates to gross margin which is sales minus the cost of goods soldThus gross. Your gross pay is what youve earned before any deductions have been taken off. For instance if ur hazard allowance is 5k monthly den after ur august salary ur year till date earning as far as ur hazard alowance goes is 40k which is total amount frm January till date august it is calculated for ur basic salary and oda allowances.

This amount could consist of a sales commission sale made at the end of last year but not paid out until this year. Gross income is the amount an employee earns before taxes and deductions are taken out. Total Deductions Details total of all Deductions 19.

Taxable Pay Taxable pay is Gross Pay minus any tax-free elements eg. Independent contractors are not your employeesthey are self-employed people hired for a specific job. Earnings are defined in IRS 1040 instructionsfor items included on line 7 pages 19-20 and in the IRS general.

This is the total amount of pay in the fiscal year that is subject to federal taxation. Den at d end theres a grand. The total income amount or gross income is used as the basis to calculate how much the individual or organization owes the.

Year-to-date earnings are the gross earnings for an employee for the period from the beginning of the year through the date of the report or payroll record. For full-time employees YTD payroll represents their gross income. Creditors often look at your gross salary when determining whether or not they should extend you credit and if.

YTD income for businesses and YTD income for individuals are calculated differently. Your net pay is what you actually receive into your bank account once all the deductions have been taken off. Net Pay Details Net Pay take-home pay.

STILL CONFUSED OR WANT TO CHECK ANOTHER TERM NOT LISTED HERE. Ytd is d total amour u v been paid frm January till date. If you work more than one job youll have a gross salary amount for each one.

Gross salary is the term used to describe all of the money youve made while working at your job figured before any deductions are taken for state and federal taxes Social Security and health insurance. This is the difference between total Pay and Allowance minus total of Deductions. YTD Deductions - this is the amount that was deducted from a persons YTD Gross for taxes 401k plan health savings account commuter benefits and other factors.

YTD Gross - this is the amount a person earned for the year before deductions. YTD stands for Year to Date. This is different than what it means for a business where year-to-date represents the overall earnings all employees earned.

It includes whatever base salary an employee receives along with other types of payment that accrue during the course of their work which. YTD can also include the money paid to your independent contractors.

Understanding The Contents Of A French Pay Slip Fredpayroll

Simple Income Statement Template Lovely 11 In E Statement Examples Sample Example Format Income Statement Statement Template Financial Statement

Gross Wages What Is It And How Do You Calculate It The Blueprint

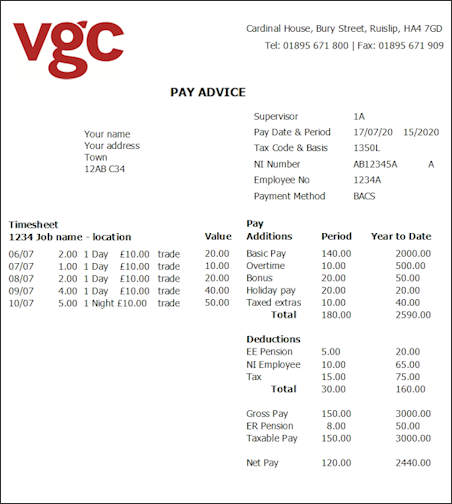

How To Read Your Payslip Vgc Group

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

The Complete Guide To Bookkeeping For Small Business Owners Small Business Finance Small Business Organization Bookkeeping Business

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Https Pssc Gov Ie Wp Content Uploads Payslip Explained Extended Version 161019 Pdf

Ytd Calculator And What Is Year To Date Income Calculator

Payslip In Spain How Does It Work Blog Parakar

Payslip In Spain How Does It Work Blog Parakar

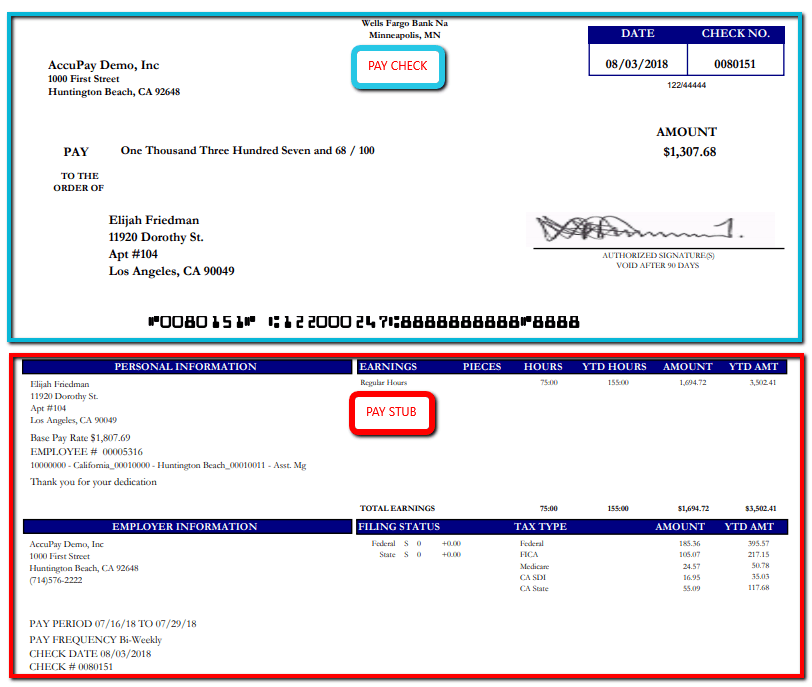

A Guide On How To Read Your Pay Stub Accupay Systems

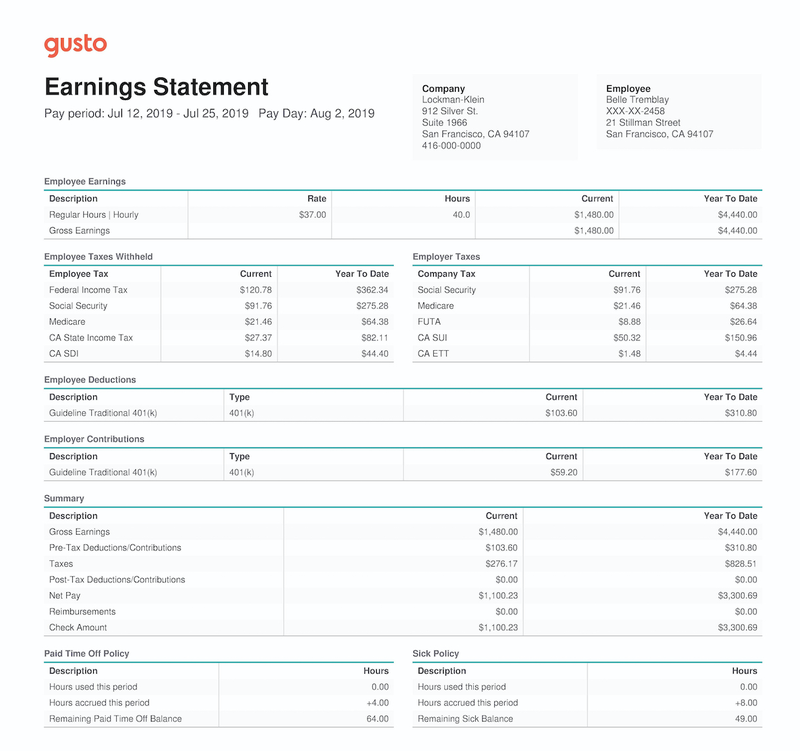

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Payslip In France How Does It Work Blog Parakar

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Hrpaych Yeartodate Payroll Services Washington State University

Payslip In France How Does It Work Blog Parakar

We Make A Personalized High Quality Paycheck Stub W Company Logo For You Including Income Taxes Deductions Ytd Totals Credit Card App Paycheck Dr Note

Payslip In France How Does It Work Blog Parakar

Post a Comment for "Ytd Gross Salary Meaning"